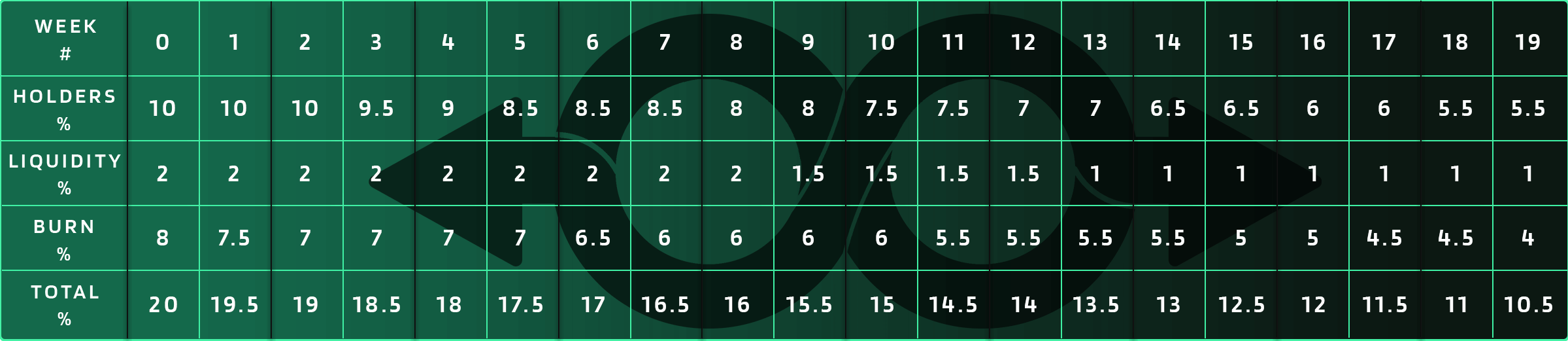

Individual-Based Tax System

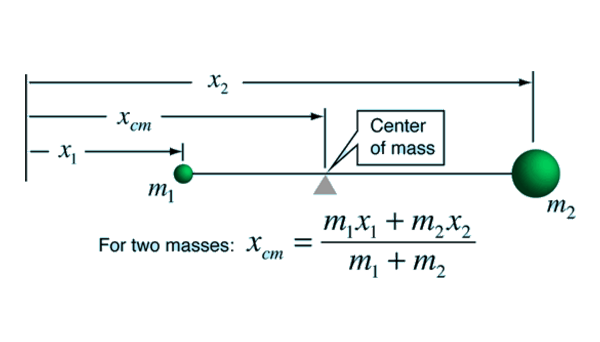

Swap TC is the first crypto token to develop a system that rewards long-term holders on an individual basis as opposed to global taxation models. The tax system that has been formulated was inspired by the Center of Mass Formula used in Physics.

Reflections BNB (BEP20)

All token holders will receive BNB (BEP20) redistribution automatically based on volume and the amount of $SWAPTC they're holding. The minimum number of tokens held required to receive reflections is 250 million. Keep track of global and individual reflections with our reflection tracker. Users will have the option to connect their wallets or manually input their public wallet address to view their reflection rates.

Additionally, users will be able to see what tax bracket they currently reside in. This utility is simple but critical due to our unique individual-based tax system which will be further explained below.